Tat Capital is a corporate Finance, Foreign Exchange, Working Capital and Family Office Advisory Uniting Australia and Indian Subcontinent. Facilitating trade and investment ideas, and a non-bank FX provider enabling sharper FX conversions, faster global payments linked with Faster Payment System (FPS), Single Euro Payment Area (SEPA) and SWIFT and smarter solutions with simple account administration in one platform.

Focusing on growth-driven Australian, New Zealand and Indian Subcontinental businesses.

As an established Account/Program Manager for non-bank FOREIGN EXCHANGE Providers. You are able to benefit from competitive FX rates, faster global payments linked with FPS, SEPA and SWIFT and hedging solutions for corporates and family offices.

Exclusive ecosystem for Family Offices to connect, collaborate and co-invest.

Cost-effective and innovative solutions for the entire working capital cycle for small, medium and large businesses.

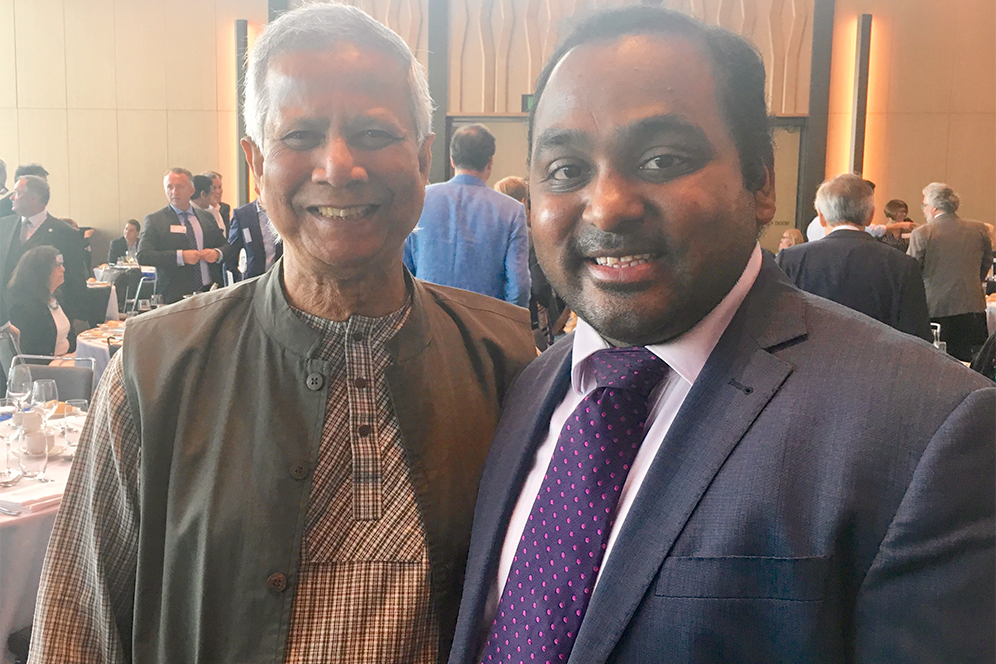

The team at Tat Capital are highly knowledgeable, professional, and will deliver the outcome they say they will. The size and quality of their network is very impressive, and if they don't have the answer to your question on hand, they'll definitely be able to connect you with someone who does.