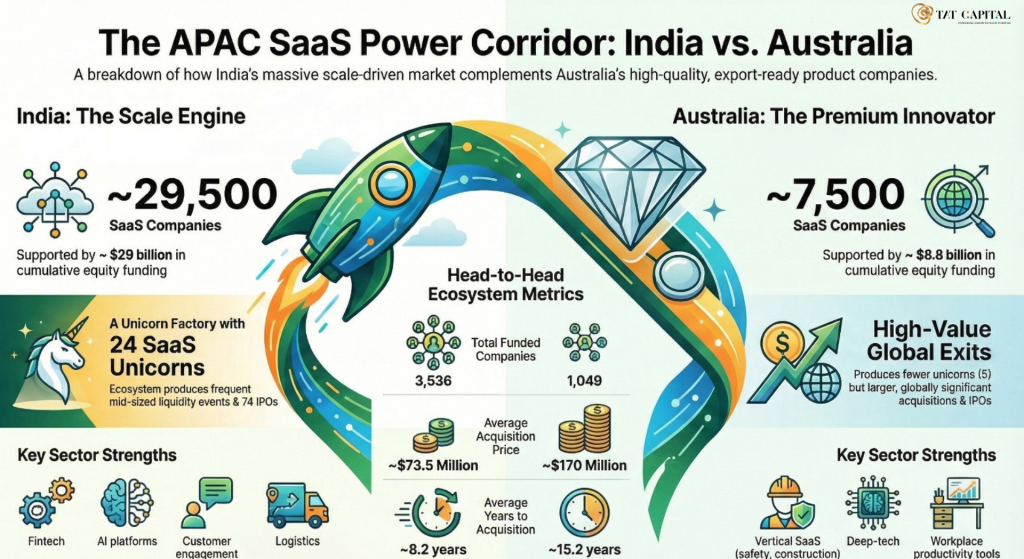

Australia and India together form one of the most important SaaS corridors in Asia–Pacific. India brings scale and depth of deal flow, while Australia produces a high concentration of global-grade, export-ready SaaS leaders.

India hosts 29,500+ SaaS companies with nearly USD 29B in cumulative funding, while Australia has 7,500+ SaaS companies with around USD 8.8B raised. Funding in both markets peaked in 2021 and has since normalised, pointing to a cyclical reset rather than a structural slowdown.

India has delivered frequent mid-market exits (306 acquisitions, 74 IPOs, 24 unicorns), while Australia has produced fewer but globally significant outcomes (315 acquisitions, 56 IPOs). Sector strengths are complementary—India leads in fintech, AI and horizontal SaaS, while Australia excels in vertical SaaS, deep-tech, and early-global products.

The takeaway for investors: India is the scale engine; Australia is the source of differentiated, premium SaaS. Together, they create a compelling case for co-investment and cross-border GTM.