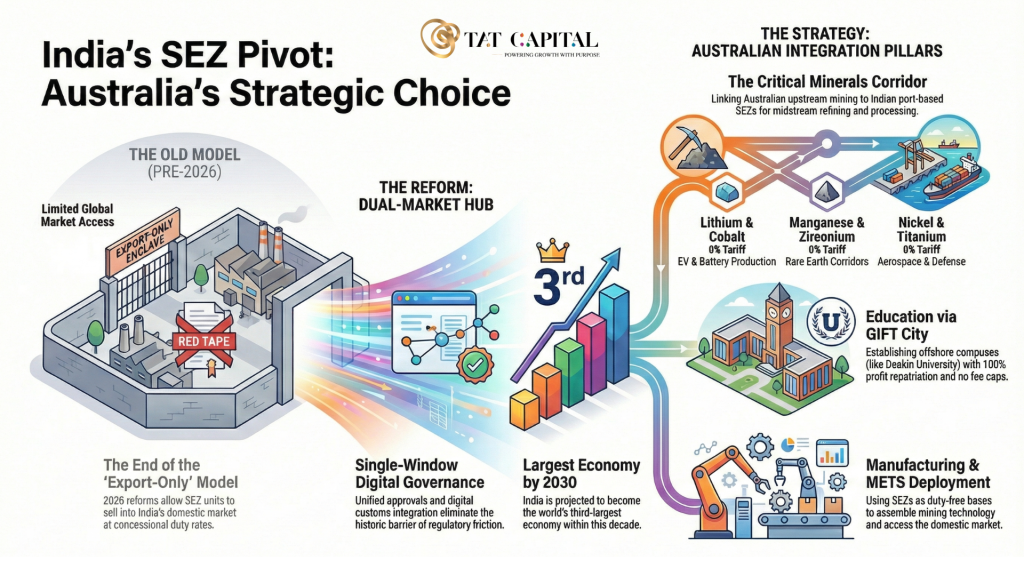

India’s Special Economic Zone (SEZ) framework is undergoing a structural evolution. What began as export-oriented enclaves is now transforming into a hybrid industrial model that integrates export competitiveness, domestic market access, digital governance, and sector-specific industrial corridors.

Under the Union Budget 2026–27 and associated policy reforms, India is repositioning SEZs as dual-market manufacturing and innovation hubs—capable of serving both global supply chains and India’s fast-growing domestic economy.

For Australia, this shift presents a timely strategic opportunity. Through the Australia-India Economic Cooperation and Trade Agreement (ECTA) and the Critical Minerals Investment Partnership, Australian firms can leverage Indian SEZs across four key pillars:

- Critical minerals processing

- Education exports via financial free zones

- Mining Equipment, Technology and Services (METS) deployment

- Advanced manufacturing and domestic market access

This paper outlines how India’s SEZ reforms work and how Australia can position itself within this evolving industrial architecture.

I. The Critical Minerals Processing Corridor

Australia holds large reserves of lithium, cobalt, and rare earth elements but faces domestic refining capacity constraints.

India provides industrial processing infrastructure within port-based SEZs.

Structural Advantage Under ECTA

Australia-India Economic Cooperation and Trade Agreement eliminates tariffs on key Australian mineral exports including lithium, cobalt, zirconium, manganese, nickel and titanium.

This reduces cost barriers for exporting ore to Indian SEZ-based processing facilities.

Dedicated Rare Earth Corridors

Budget 2026 proposes dedicated corridors in Odisha, Kerala, Andhra Pradesh and Tamil Nadu—creating ready-made ecosystems for refining and downstream manufacturing.

Strategic Investment Alignment

Khanij Bidesh India Limited has engaged in overseas mineral acquisition strategies, including interest in Australian lithium projects.

This enables:

- Equity investment into Australian mining projects

- Secured offtake agreements

- Supply chain diversification away from single-country dominance

The corridor model integrates: Australian upstream extraction → Indian midstream refining → Global battery and EV supply chains

This strengthens resilience and geopolitical diversification.

II. Education Corridor via GIFT City

GIFT City allows foreign universities to establish branch campuses under regulatory flexibility.

Australia has already secured first-mover advantage:

- Deakin University

- University of Wollongong

Both have established campuses in GIFT City.

Key advantages:

- No domestic fee caps

- No reservation quotas

- Free profit repatriation

- Access to India’s expanding middle-class student base

This represents a structural shift in Australia’s education export model—from inbound migration-based revenue to offshore campus monetisation.

III. Deploying METS into Manufacturing SEZs

Australia’s Mining Equipment, Technology and Services (METS) sector can establish assembly or service bases in engineering SEZs such as:

- Aequs SEZ

- KIADB Aerospace SEZ

Advantages:

- Duty-free import of specialised components

- Competitive local manufacturing costs

- Export base to Africa and Middle East

- Access to India’s modernising mining industry

Budget 2026’s SME Growth Fund further supports joint ventures with Indian MSMEs.

IV. Accessing India’s Domestic Consumer Market

The DTA reform allowing concessional domestic sales is transformative.

Australian firms operating in:

- Food processing

- Premium agri-products

- Engineering equipment

- Consumer manufacturing

can now:

- Export globally from SEZs

- Sell into India’s domestic market when export demand fluctuates

- Undertake reverse job work for Indian companies

This reduces volatility risk and increases asset utilisation.

Through ECTA and parallel strategic agreements, Australia can integrate into India’s SEZ transformation in four primary ways.

1. How India’s SEZ Framework Creates a Competitive Investment Environment

India’s SEZ model rests on two structural advantages: (1) Fiscal incentives to lower operating costs (2) Administrative simplification to reduce time and regulatory risk**

A. Single-Window Governance: Reducing Administrative Friction

Historically, India’s regulatory complexity deterred foreign investors. The SEZ framework addresses this through:

Unified Approvals

SEZ units operate under a single-window clearance mechanism covering both central and state-level approvals.

Decentralized Decision-Making

Unit approvals are handled by the Unit Approval Committee (UAC) at the zonal level, led by the Development Commissioner. This removes the need to approach multiple ministries in Delhi.

Delegated State Powers

Many states have delegated statutory powers—such as labour and environmental clearances—to the Development Commissioner, effectively creating a single compliance interface.

Digital Integration (Budget 2026 Reform)

Cargo clearance approvals are being integrated into a unified digital window, enabling near-instant clearance for goods without compliance flags.

The result: lower transaction costs, faster commissioning timelines, and improved predictability for foreign investors.

B. Fiscal Incentives: Enhancing ROI

India’s SEZs provide direct and indirect tax advantages that materially improve capital efficiency.

Direct Tax Benefits

- Historic income tax exemptions under Section 10AA attracted initial waves of export manufacturing.

- Budget 2026 introduces targeted tax holidays for emerging sectors such as cloud services operating via Indian data centres (exemption until 2047 in specified cases).

- Non-residents taxed on a presumptive basis are proposed to be exempt from Minimum Alternate Tax (MAT).

Indirect Tax Exemptions

- 100% customs duty exemption on capital goods and raw materials

- Zero-rated GST on domestic procurement

- Exemptions from transaction taxes in financial zones

These incentives reduce upfront capex burdens and improve long-term operating margins.

C. Operational Flexibility and Capital Freedom

India’s SEZ regime further supports foreign investors through:

- 100% FDI under the automatic route in most manufacturing sectors

- Full foreign exchange retention in EEFC accounts

- Free repatriation of profits

- Public Utility Service classification in many zones, ensuring industrial continuity

A Major Shift: Domestic Market Access (Budget 2026)

The most significant reform is allowing SEZ units to sell into the Domestic Tariff Area (DTA) at concessional duty rates.

This transforms SEZs from pure export enclaves into dual-market hubs, reducing exposure to global trade volatility and enabling idle capacity utilization.

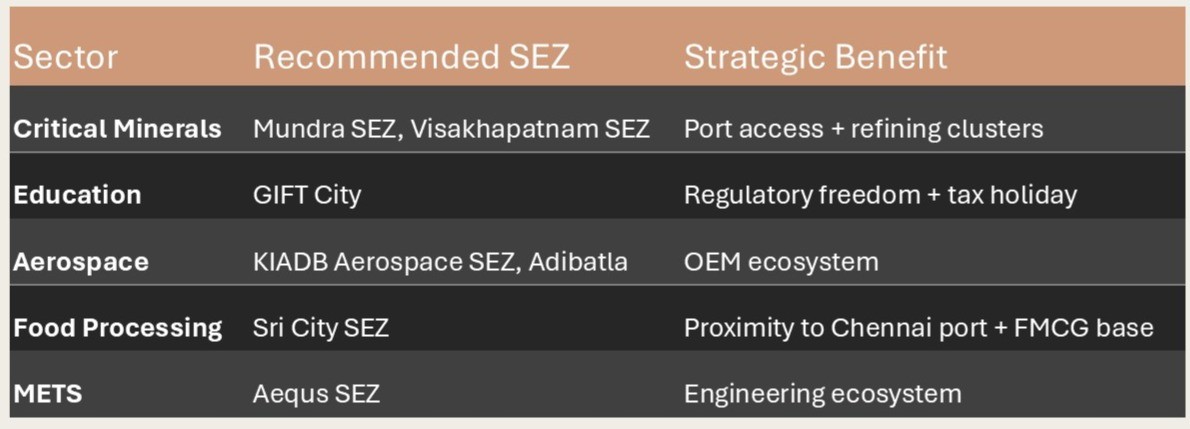

2. Sectoral Strength of Key Indian SEZs

India’s SEZ ecosystem is sector-diversified and geographically strategic.

A. Port-Based Mega Hubs

Mundra SEZ (Gujarat)

Operated by the Adani Group, Mundra is India’s largest multi-product SEZ. It includes sectoral clusters in textiles, food processing, electronics, and chemicals, supported by Free Trade Warehousing Zones.

Sri City SEZ (Andhra Pradesh)

A 7,000-acre integrated business city hosting global firms across manufacturing sectors. It has successfully attracted multinational investment and transformed regional employment dynamics.

Kandla SEZ

Asia’s first Export Processing Zone (1965), still a major export hub in engineering and chemicals.

B. Aerospace and Defence Clusters

India is moving up the value chain in aerospace manufacturing.

KIADB Aerospace SEZ (Bengaluru)

Hosts Tier-1 aerospace suppliers integrated into global supply chains.

Aequs SEZ (Belgaum)

Precision engineering hub supporting aerospace manufacturing with strong regional employment impact.

Adibatla Aerospace SEZ (Hyderabad)

Home to Tata Boeing Aerospace Limited, manufacturing aero-structures for Apache helicopters.

These zones reflect India’s ambition to shift from assembly to high-value co-development.

C. Pharmaceuticals and Biotechnology

India’s “Pharmacy of the World” positioning is supported by:

- Visakhapatnam SEZ (major pharma export hub)

- Jawaharlal Nehru Pharma City (bulk drug manufacturing ecosystem)

- Serum BioPharma Park (Pune)

- Biocon SEZ (Bengaluru)

These zones combine scale, regulatory compliance, and export competitiveness.

D. Financial Innovation: GIFT City (IFSC)

GIFT City represents a different model.

As India’s International Financial Services Centre:

- 10-year tax holiday within a 15-year block

- Exemption from STT and CTT

- Unified regulator: International Financial Services Centres Authority

- Treated as a non-resident zone under foreign exchange regulations

It allows free foreign currency transactions and regulatory flexibility unavailable elsewhere in India.

3. Strategic SEZ Entry Points for Australia

4. Geostrategic Significance

India’s SEZ reforms reflect a broader ambition: transition from a service-led economy to a manufacturing and innovation powerhouse.

For Australia, engagement is not merely commercial—it is structural.

It enables:

- Diversified mineral processing pathways

- Reduced dependency on concentrated supply chains

- Offshore education scaling

- Industrial co-development in aerospace and advanced manufacturing

- Entry into one of the world’s fastest-growing consumer markets

The SEZ framework—especially under Budget 2026 reforms—positions India as a complementary industrial partner rather than merely a trade destination.

Conclusion

India’s SEZ ecosystem is no longer a static export model. It is evolving into a digitally integrated, dual-market, sector-specialised industrial platform.

Through ECTA, the Critical Minerals Partnership, and targeted sectoral engagement, Australia can:

- Embed itself in India’s industrial corridors

- Co-develop strategic supply chains

- Expand education exports structurally

- Access long-term domestic demand growth

The opportunity lies not just in exporting to India—but in integrating into India’s industrial transformation through its SEZ architecture