The global investment playbook is being quietly rewritten.

As we move into 2026, capital is no longer responding primarily to interest-rate cycles or central bank guidance. Instead, we are firmly in a fiscally dominant world—one where government spending on defence, infrastructure, energy transition, and supply-chain resilience is shaping capital flows far more decisively than monetary policy.

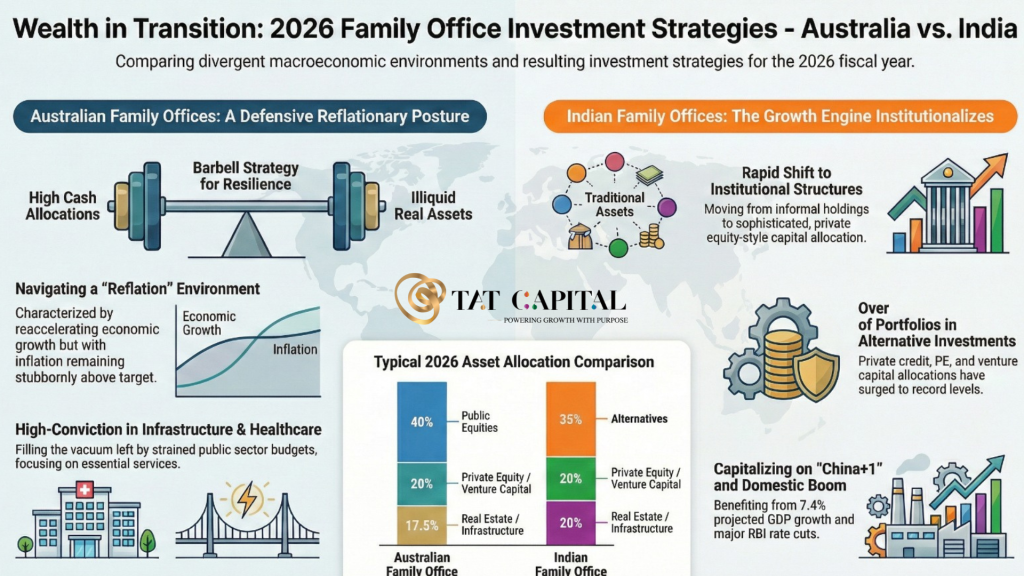

This shift is creating two very different strategic responses across family offices in Australia and India.

Australia: Managing Reflation, Preserving Optionality

Australian family offices are navigating a constrained growth environment marked by persistent inflation, cautious central bank policy, and rising fiscal pressure at the state level. The response has been pragmatic rather than opportunistic.

Portfolios are increasingly structured around a barbell strategy—holding higher levels of liquidity and defensive assets on one end, while committing meaningfully to illiquid real assets such as infrastructure, private credit, and institutional residential development on the other. Cash is no longer viewed as idle capital, but as strategic optionality. Gold has also re-emerged as a serious portfolio hedge in a world of rising sovereign debt and geopolitical risk.

The focus here is clear: protect capital, stay flexible, and selectively deploy into the real economy where policy support is strongest.

India: Institutional Capital Meets Structural Growth

India presents a fundamentally different picture. Strong GDP growth, accommodative policy, and the acceleration of domestic manufacturing, digital infrastructure, and private markets have pushed family offices into a rapid phase of institutionalisation.

Indian family capital is moving decisively into private equity, venture, and private credit—often exceeding 40% of portfolio allocation. This is not speculative risk-taking, but patient capital filling gaps left by global funds and supporting growth-stage and pre-IPO companies. In public markets, the focus has shifted from momentum to quality, with a strong preference for long-term “compounder” businesses aligned to domestic demand.

This evolution signals a deeper change: family offices are no longer passive allocators but active partners in India’s economic expansion.

The Common Thread: Active Stewardship

Despite their different macro paths, both markets point to the same conclusion. Passive strategies are becoming less relevant. Success in this decade will depend on active stewardship—combining disciplined governance, longer investment horizons, professionalised decision-making, and alignment with structural themes such as AI, energy transition, and resilient infrastructure.

For family offices globally, 2026 is not about timing the next cycle. It’s about designing portfolios that can compound through volatility and remain relevant for the next generation.

#FamilyOffice #PrivateCapital #IndiaGrowth #AustraliaInvesting #WealthStrategy #PrivateMarkets #ActiveStewardship #2026Outlook